NOTE LOCATION CHANGE: WCW LIBRARY (998 Marshall Road, VV)

4:00-4:15pm Elementary Rep and Director Networking Time

4:15-5:15pm General Meeting

5:15-5:30pm Secondary Rep and Director Networking Time

- Approval of Minutes from last meeting

- Approval of Agenda (with flexibility) of this meeting

- New and/or Continuing Business Items:

- Donation to SEIU food insecurity drive

- President’s Report: Brenda Hensley

- President Site Visits Reminder

- Number of Reps, Membership Percentage and Site $$$ Spreadsheet

- Check In Report Review (on district shared drive)

- ELOP

- Treasurer’s Report: Daniel Rodriguez

- Approval of Treasurer’s Financial Report 25-26 Fiscal Year

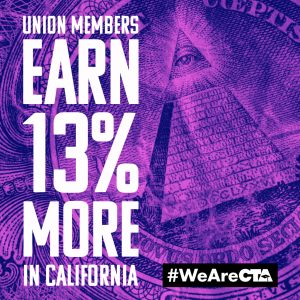

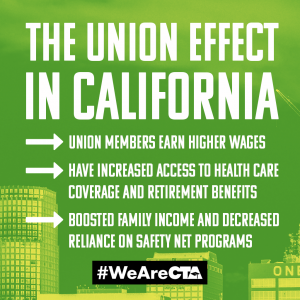

- NEA/CTA/VTA Dues Structure

- Non-Conference Reimbursement Form

- Bargaining Report: Megan Morris

- MOU Cheat Sheet

- Other Committee Information:

- Grievance: Lisa Cusi

- BAC (Budget Advisory Committee): Brenda Hensley, Keri Tafuro, Michelle McGilvary (website)

- PAC Report: Chair Pending

- Sign up for School Board Meet and Greets HERE

- VTA PAC recruitment

1 – Prop 55 paid signature gathering

2 – Solano BOE updates

3 – Quarterly meetings

4 – Organizing

5 – Long term planning/PAC Assessment

6 – School Board 2026 – current board – district lookup

- New Educator: Rachel Bulris

- Safety: Jaxie Murray

- Membership Engagement: Alyson Brauning

- Equity: Tricia Cowen Equity Team 2025-2026

- Labor Council Reps: Corey Penrose, Jennifer Dickinson, Alyson Brauning, Brenda Hensley

- State Council: Keri Tafuro, Ariel Ray, Alyson Brauning

- Budget Survey and Budget Forum

- Membership: Jax Stornetta – VTA Membership List (Updated 10/14/25)

- Please review, look for new members that are missing

- Elections: Aaron Stephens

- Sick Leave Bank: Julie McGee Leave Bank.pdf

- SPED Quarterly Meeting Committee: Becky Wylie and Marja Santos (Sped Committee Report)

- Site Member Engagement Planning Time: 25-26 Planning Tool

- Old plans: 24-25 plans and 23-24 plans

- Other

- Raffle